Getting The Eb5 Immigrant Investor Program To Work

Getting The Eb5 Immigrant Investor Program To Work

Blog Article

Eb5 Immigrant Investor Program Fundamentals Explained

Table of ContentsAll about Eb5 Immigrant Investor ProgramSome Known Facts About Eb5 Immigrant Investor Program.See This Report on Eb5 Immigrant Investor ProgramHow Eb5 Immigrant Investor Program can Save You Time, Stress, and Money.About Eb5 Immigrant Investor ProgramUnknown Facts About Eb5 Immigrant Investor Program

In spite of being less popular, various other pathways to getting a Portugal Golden Visa consist of investments in financial backing or personal equity funds, existing or brand-new company entities, resources transfers, and donations to sustain clinical, technical, artistic and cultural growths. Holders of a Portuguese resident permit can also function and examine in the country without the demand of getting added licenses.

Some Known Incorrect Statements About Eb5 Immigrant Investor Program

Capitalists have to have both an effective entrepreneurial background and a significant organization track record in order to use. They may include their partner and their children under 21-years- old on their application for irreversible house. Effective candidates will receive a renewable five-year reentry permit, which permits open traveling in and out of Singapore.

Things about Eb5 Immigrant Investor Program

Applicants can invest $400,000 in federal government accepted real estate that is resalable after 5 years. Or they can spend $200,000 in government accepted actual estate that is resalable after 7 years.

This is the main benefit of immigrating to Switzerland compared to various other high tax obligation nations. In order to be eligible for the program, candidates should Be over the age of 18 Not be used or occupied in Switzerland Not have Swiss citizenship, it must be their very first time staying in Switzerland Have rented or purchased house in Switzerland Give a lengthy listing of recognition documents, consisting of tidy criminal record and good ethical character It takes around after repayment to acquire a resident permit.

Tier 1 visa holders remain in status for about three years (depending on where the application was submitted) and have to apply to prolong their remain if they want to continue residing in the United Kingdom - EB5 Immigrant Investor Program. Prospects need to have personal properties that worth at greater than 2 million and have 1 numerous their very own money in the U.K

Little Known Facts About Eb5 Immigrant Investor Program.

The Tier 1 (Business Owner) Visa stands for three years and 4 months, with the choice to expand the visa for an additional 2 years. The candidate might bring their reliant member of the family. When the entrepreneur has been in read more the UK for five years, they can make an application for uncertain delegate continue to be.

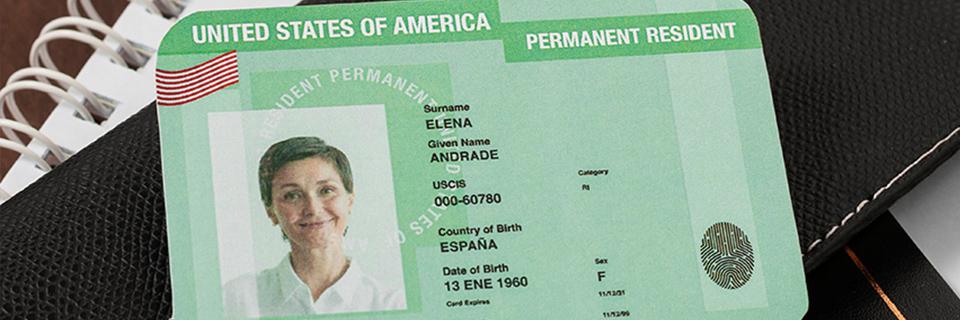

Investment migration has actually been on an upward fad for even more than twenty years. The Immigrant Capitalist Program, also called the EB-5 Visa Program, was developed by the united state Congress in 1990 under the Migration Act of 1990 or IMMACT90. Its primary objective: to here boost the united state economy via work creation and capital expense by foreign financiers.

This consisted of reducing the minimal investment from $1 million to $500,000. In time, modifications have actually raised the minimal financial investment to $800,000 in TEAs and $1.05 million in other locations. In 1992, Congress sought to boost the effect of the EB-5 program by presenting the Regional Facility Pilot Program. These privately-run entities were designated to promote economic development and task development within particular geographic and sector fields.

Getting My Eb5 Immigrant Investor Program To Work

Visas are "reserved" each : 20% for rural, 10% for high unemployment, and 2% for facilities. Unused gets rollover to the following year. Developers in backwoods, high unemployment areas, and infrastructure jobs can gain from a dedicated pool of visas. Capitalists targeting these certain areas have actually an increased possibility of visa availability.

Capitalists currently have the chance to spend in government-backed infrastructure projects. Investors need to be aware of the accepted types of investment funds and arrangements. Investors and their family members currently legally in the United state and eligible for a visa number might concurrently file applications for change of standing along with or while awaiting adjudication of the financier's I-526 request.

This improves the process for investors already in the U.S., quickening their capacity to change condition and preventing consular visa handling. Rural jobs get top priority in USCIS processing. This motivates programmers to launch jobs in backwoods because of the quicker handling times. Capitalists looking for a quicker processing time may be much more likely here to buy country jobs.

Little Known Facts About Eb5 Immigrant Investor Program.

Seeking U.S. government info and services?

To qualify, candidates need to spend in brand-new or at-risk commercial business and create full time positions for 10 qualifying staff members. The U.S. economy advantages most when a location is at risk and the new financier can provide a working establishment with complete time work.

TEAs were implemented into the financier visa program to urge spending in places with the biggest need. TEAs can be country locations or locations that experience high joblessness.

Report this page